When Can I Contribute To Roth Ira For 2025 - ira contribution limits 2025 Choosing Your Gold IRA, You are allowed to contribute the full $7,000 to your roth ira if your modified adjusted gross income (magi) is less than $146,000 in 2025. Only earned income can be contributed to a roth individual retirement account. Can you contribute 6000 to both Roth and traditional IRA? Retirement, For 2025, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older. The 2023 contribution deadline for roth and traditional iras is april 15, 2025.

ira contribution limits 2025 Choosing Your Gold IRA, You are allowed to contribute the full $7,000 to your roth ira if your modified adjusted gross income (magi) is less than $146,000 in 2025. Only earned income can be contributed to a roth individual retirement account.

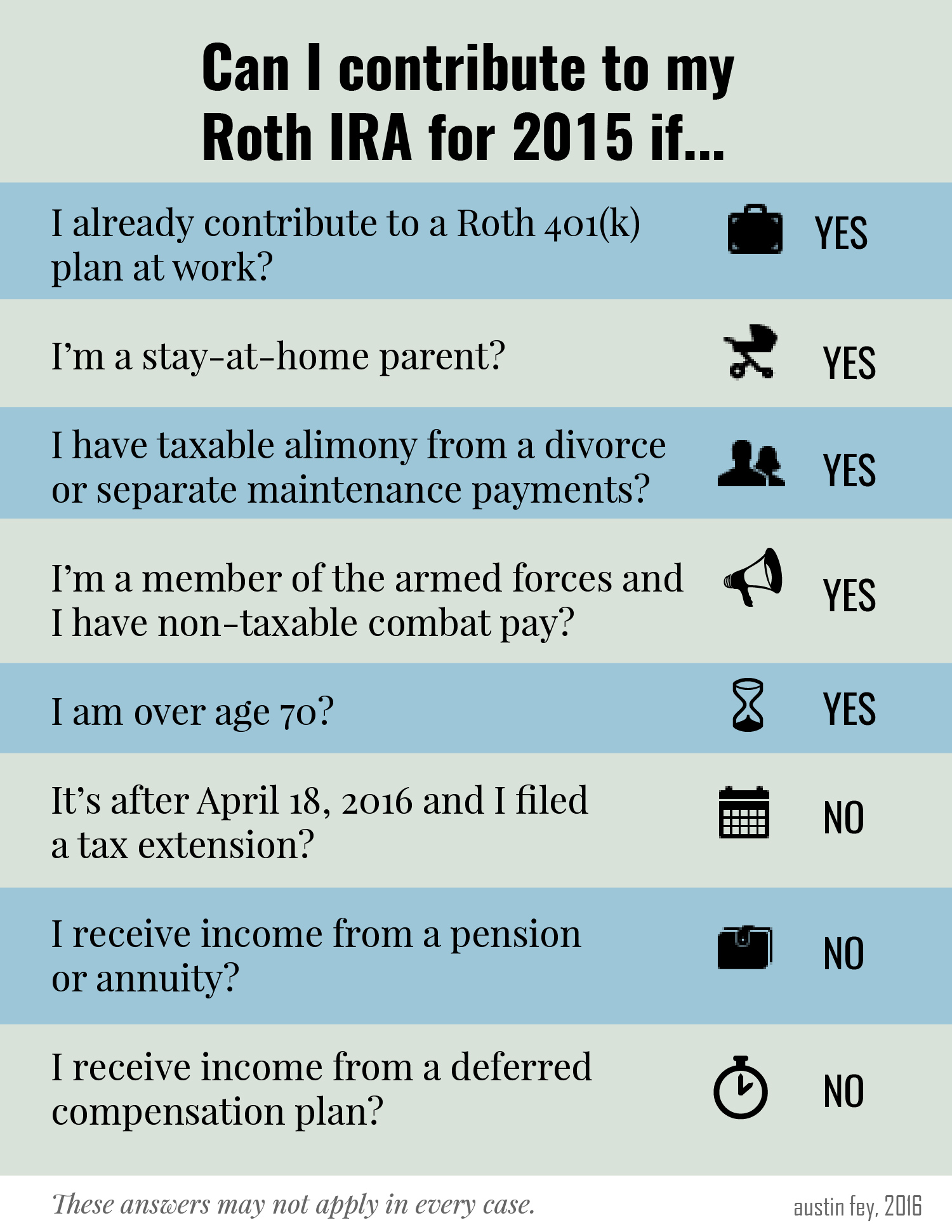

Can I Contribute to my Roth IRA? Marotta On Money, For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. The 2023 contribution deadline for sep iras is by the employer's tax.

Whether you can contribute the full amount to a roth ira depends on. In 2025, you can contribute up to $7,000 if you are under 50, while those older can bump it up to $8,000.

2025 Simple Ira Contribution Ilise Leandra, Whether you can contribute the full amount to a roth ira depends on. Who can contribute to a roth ira?

Treasure Fest San Francisco 2025. Joe cahn, the late ‘commissioner of tailgating’ and new orleans school of cooking founder, suggested…

The 2023 contribution deadline for roth and traditional iras is april 15, 2025.

Only earned income can be contributed to a roth individual retirement account.

How much can I contribute to my Roth IRA 2023 Inflation Protection, Only earned income can be contributed to a roth individual retirement account. The roth ira contribution window for 2025 opens on jan.

Brunch With Santa Long Island 2025. Indulge in mouthwatering brunch specials while creating cherished memories with family and. Join santa…

Why Most Pharmacists Should Do a Backdoor Roth IRA, $6,500 if you're younger than age 50. This deadline expires when 2023 taxes are due on april 15, 2025.

When Can I Contribute To Roth Ira For 2025. You can contribute to a roth at any age—even past full retirement age—as long as you earn taxable income. For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined.